Updated on:

| Written by:

The Ripple Effect: Trump Tariffs 2025 and Their Implications for IT Infrastructure

- Introduction: The Trump Tariffs 2025 and Their Impact on IT Infrastructure

- Breaking Down the Tariffs: Who’s Affected and Why It Matters

- What This Means for IT Hardware Procurement

- Impact on Data Center & Telecom Operators

- Lessons from the 2018–2020 Tariff Era

- How European and Global Operators Will Be Affected

- The Future of Global Supply Chains

- What IT Decision-Makers Should Do Now

- FAQs: How Trump Tariffs 2025 Are Impacting IT and Data Centers

- Final Thoughts

- Further Reading on the 2025 Trump Tariffs

Key Takeaways

- New tariffs announced April 2, 2025, hitting key tech manufacturing nations: China (34%), Taiwan (32%), South Korea (25%), and more.

- Server memory, SSDs, CPUs, and networking gear expected to rise in cost—both OEM and compatible options affected.

- China has retaliated, further straining global supply chains and procurement timelines.

- Delivery times may increase as suppliers reroute sourcing and face customs bottlenecks—especially for U.S.-bound orders.

- Regional diversification is accelerating, with India, Vietnam, Mexico, and Eastern Europe gaining attention.

- Production closer to end-markets (U.S. or EU) is being explored but remains a long-term play.

- IT leaders should act now: review sourcing strategies, secure critical components, and budget for volatility.

Introduction: The Trump Tariffs 2025 and Their Impact on IT Infrastructure

On April 2, 2025, President Donald Trump announced the reintroduction and expansion of tariffs targeting key technology-producing countries. For data centers, telecom operators, and enterprise IT teams, this development presents significant challenges that could affect infrastructure planning and budget forecasts.

These tariffs impact the global manufacturing hubs responsible for producing server memory, SSDs, complete server assemblies, and high-performance network equipment. As sourcing costs rise and supply chains adjust, businesses worldwide—face growing uncertainty around pricing, lead times, and component availability. For IT procurement teams, this means increased volatility and the need for strategic adjustments to sourcing and supply chain planning.

China has already responded with retaliatory tariffs on U.S. tech exports, further escalating the situation and threatening to fragment global sourcing channels. The ripple effect is real—and it’s reshaping how infrastructure gets built in 2025.

Breaking Down the Tariffs: Who’s Affected and Why It Matters

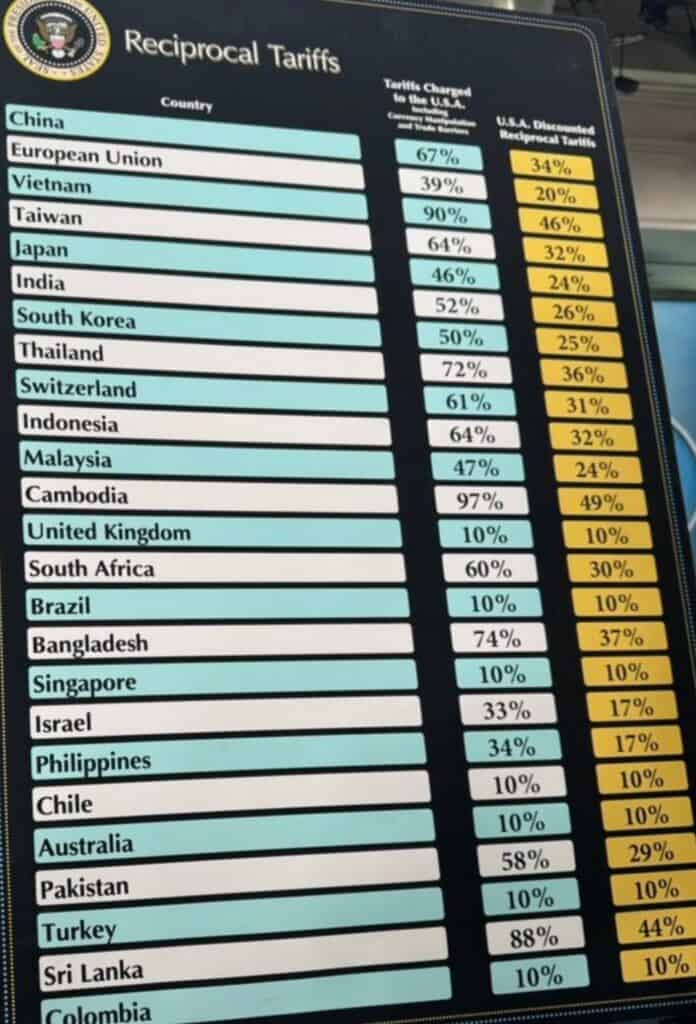

The Trump Tariffs 2025 are not broad strokes—they’re calculated strikes at the core of global tech manufacturing. Here’s a snapshot of the most significant regions affected, based on the newly announced “reciprocal tariffs”:

- China: 34%

- Taiwan: 32%

- South Korea: 25%

- Vietnam: 26%

- European Union: 20%

- Japan: 25%

- India: 26%

- Malaysia: 24%

- Thailand: 25%

- Philippines: 10%

- Singapore: 10%

- Israel: 10%

A baseline 10% tariff applies to all other imports.

These countries are not just names on a trade sheet—they represent the core manufacturing regions behind today’s IT infrastructure. From DRAM and NAND production (South Korea, Taiwan, Malaysia) to server assembly hubs (China, Vietnam, Thailand), and precision electronics (Japan, Israel, EU), the supply chain is tightly linked to these geographies.

For IT buyers sourcing server memory, SSDs, network gear, or full server systems, these tariffs bring higher costs and added risk. It’s no longer just about what’s available—it’s about what’s cost-effective and deliverable.

What This Means for IT Hardware Procurement

The Trump Tariffs 2025 are already reshaping the economics of IT hardware procurement. With import duties now stacked on top of already volatile component prices, buyers across data centers, telecom, and enterprise IT face a complex and shifting cost landscape.

Semiconductors, which underpin everything from CPUs to RAID controllers, are particularly exposed. With leading-edge chips sourced primarily from South Korea, Taiwan, and Japan, the 25–32% tariffs translate into higher unit prices—especially for advanced server-class processors and network logic.

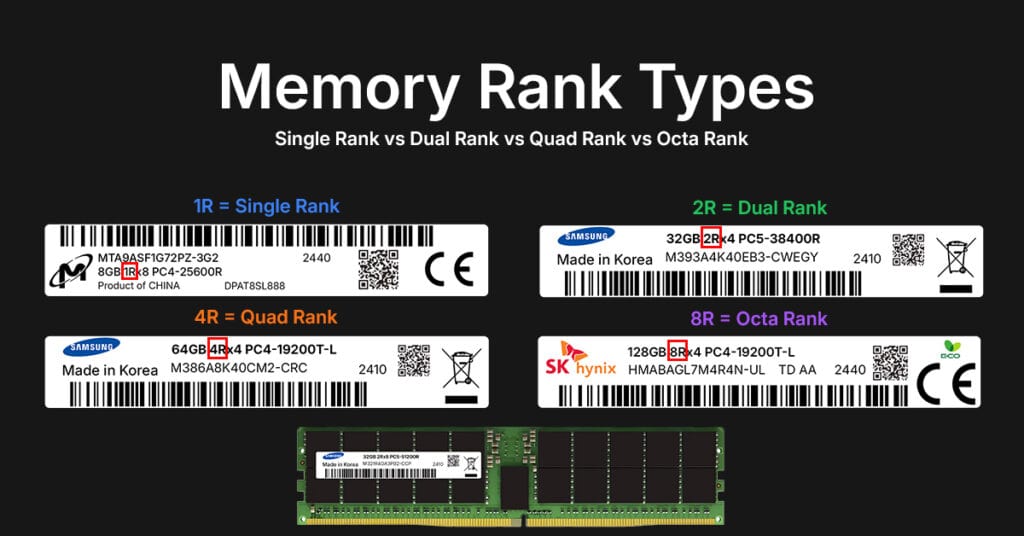

Memory modules and SSDs, two of the most heavily traded components, are also seeing pressure. Major suppliers in South Korea and Malaysia are already signaling upward pricing revisions of 3–5% to offset tariff impact. For buyers of high-density DDR4/DDR5 and enterprise NVMe SSDs, this could mean five-figure cost increases on bulk orders.

Servers and storage systems, often assembled in China or Southeast Asia, are impacted at the chassis level as well. Not only do individual components carry tariffs—the assembled units themselves may now be taxed at the system level, creating a compounded effect.

In fact, tariff-driven cost increases are prompting many IT buyers to seek more cost-effective alternatives. Smaller, agile suppliers offering compatible solutions—not bound by OEM pricing models or slow-moving logistics—are now in a stronger position to deliver value, speed, and flexibility when it matters most.

For IT procurement leads, the implications are direct:

- Expect 2025 infrastructure budgets to be tighter and more complex.

- Forward purchasing, supplier diversification, and tariff-adjusted pricing models will become essential strategies.

- Simply put, hardware acquisition is no longer a cost-control exercise—it’s risk management.

Impact on Data Center & Telecom Operators

Tariff pressure isn’t just a spreadsheet problem—it’s an operational bottleneck. For data centers and telecom operators, the ripple effects threaten to delay growth timelines and strain ROI calculations on major infrastructure builds.

New deployments and capacity expansions—already challenged by lead time constraints—now face budget overruns due to increased costs on racks, power systems, storage arrays, and interconnect gear. For colocation and cloud providers, that could mean slower rollout of new availability zones or compute clusters.

AI compute infrastructure, which relies on high-throughput memory, GPUs, and custom silicon—all of which are heavily tariffed—is at particular risk. For hyperscale providers, this raises a real concern: delayed AI training clusters and missed delivery milestones for enterprise clients.

Telecom tower and edge infrastructure projects are also in the crosshairs. With Trump Tariffs 2025 affecting steel, power units, and edge compute nodes, the economics of rural and 5G rollout plans could face headwinds—especially in cost-sensitive or subsidized deployments.

The bottom line:

- CapEx forecasts will need recalibration.

- Deployment timelines may slip.

- Vendors will need to prove not just performance—but geographic resilience.

Lessons from the 2018–2020 Tariff Era

The last time tariffs hit the tech sector—during Trump’s first term from 2018 to 2020—the industry got a wake-up call. Prices surged across a range of components, from semiconductors to server chassis, as tariffs on Chinese imports kicked in.

In response, many companies began to pivot their supply chains, experimenting with diversification into Southeast Asia, and for the first time in decades, bringing manufacturing back closer to home started to enter serious boardroom discussions. But the process was anything but smooth—capacity in alternate regions was limited, and the logistics of switching vendors or geographies proved slow and expensive.

What 2025 can learn from that period:

- Early movers absorbed the least pain. Those who diversified suppliers before tariffs hit full force were better insulated from price shocks.

- Bringing production closer to home is slow and costly. It’s a long-term play, not a quick fix.

- Demand didn’t go away—it shifted. Buyers turned to flexible, cost-effective partners who could deliver quickly, even if that meant moving beyond traditional OEM channels.

This time, the stakes are higher—but the playbook is clearer. Procurement agility and supplier flexibility will separate the winners from the stalled.

How European and Global Operators Will Be Affected

While the Trump Tariffs 2025 are U.S.-driven, the effects won’t stay contained within American borders. For European and global IT buyers, the consequences are both direct and indirect.

Directly, tariffs on EU tech exports to the U.S.—now set at 20%—could soften transatlantic demand, impact revenue forecasts for European vendors, and raise operational costs for any EU-based firms with U.S.-bound infrastructure. Indirectly, global price normalization is likely. When U.S. buyers pay more, global markets often follow.

Compounding this, supply chain congestion could worsen as major tech firms scramble to reroute sourcing through un-tariffed corridors, driving up lead times and tightening component availability worldwide.

And then there’s the geopolitical angle: U.S. protectionism is putting pressure on the rest of the world to adapt, accelerate self-reliance, or align with alternative trade partners. For European operators, this may present both risk and opportunity—but staying passive isn’t an option.

The Future of Global Supply Chains

The global tech supply chain is entering a realignment phase. The 2025 tariff escalation has reinforced a strategic trend already in motion: regional diversification. Instead of relying heavily on a few overexposed countries—especially those now burdened with steep tariffs—many manufacturers are shifting focus toward India, Vietnam, Mexico, and parts of Eastern Europe.

These regions offer improving logistics, government-backed incentives, and more flexibility compared to traditional hubs. For infrastructure buyers across Europe and beyond, new sourcing corridors are emerging—but each comes with its own trade-offs in scale, consistency, and lead time.

At the same time, calls to shift manufacturing closer to end markets—such as producing more within the U.S. or Western Europe—are gaining political momentum. But practically speaking, rebuilding high-volume manufacturing capacity in these regions remains a long-term goal. It’s expensive, labor-constrained, and years away from being a scalable replacement for Asia-based production.

What IT Decision-Makers Should Do Now

For CIOs, infrastructure leads, and procurement managers, 2025 demands a proactive response—not just reactive troubleshooting. The new environment rewards agility, foresight, and partners who can adapt fast.

Here’s what to prioritize:

- Reevaluate supplier contracts and sourcing locations. Build flexibility into agreements to reduce exposure to any one region.

- Secure critical components early. Memory modules, SSDs, and server units may face price jumps or availability gaps as demand surges.

- Explore compatible alternatives from trusted suppliers. Beyond pricing, these options often provide greater flexibility and faster delivery, helping teams stay on track when OEM supply chains are strained.

- Adjust 2025 CapEx budgets to reflect potential volatility. Pricing predictability is off the table—buffer room is now a necessity.

The buyers who prepare now won’t just survive—they’ll gain a competitive edge while others scramble to adapt.

FAQs: How Trump Tariffs 2025 Are Impacting IT and Data Centers

What are Trump’s 2025 tariffs?

New tariffs targeting imports from China, Taiwan, South Korea, and the EU—heavily impacting tech components like servers, memory, and IT hardware.

When did Trump’s new tariffs start?

They were announced on April 2, 2025, targeting key tech-producing countries with rates up to 46%.

How do tariffs affect IT infrastructure?

They increase hardware costs, increase delivery times, and force teams to rethink suppliers and deployment plans.

Will compatible hardware also get more expensive?

Yes, if sourced from affected regions—but they often remain more flexible and cost-effective than OEM parts.

Are European companies impacted?

Yes—both from direct tariffs and global supply chain pressure causing price hikes and sourcing issues.

Final Thoughts

Trump Tariffs 2025 aren’t just trade policy—they’re strategic disruptors. They reshape cost structures, shift supply chains, and challenge long-standing procurement assumptions.

For data centers, telecom operators, and enterprise IT leaders, the message is clear: don’t just react—act early, plan smart, and stay adaptive. The businesses that take initiative now will be the ones that maintain performance, control costs, and outpace slower-moving competitors.

Volatility creates risk—but also opens opportunity. The advantage belongs to those who prepare.

Further Reading on the 2025 Trump Tariffs

Want to dig deeper into the implications of the new tariffs? These expert analyses offer more perspectives on the impact across tech, data centers, and supply chains:

- Reuters – How Trump tariffs could stymie Big Tech’s U.S. data center spree

- Economic Times – Trump tariffs may hinder data center investments

- WIRED – Trump’s global tariffs and the ripple effect on the tech industry

- Forbes – Seismic implications for high-tech firms

- CNBC – Trump says tariffs will drive reshoring—but experts are skeptical

- Data Centre Magazine – What the latest Trump tariffs mean for the tech industry

About the Author

Edgars Zukovskis

Board Member | CoreWave Labs

14+ years of expertise helping telecom operators, datacenters, and system integrators build efficient, cost-effective networks using compatible hardware solutions.

Server Memory for Top Brands

Select Your Server Brand to Find Compatible Memory

Recommended Reads

Discover insights to power your infrastructure.