Updated on:

| Written by:

DRAM Price Increase: DDR4 and DDR5 Server Memory Outlook for 2026

- Introduction: Why DRAM Prices Matter in 2026

- 1. 2026 DRAM Market Snapshot

- 2. Key Drivers Behind the DRAM Price Increase

- 3. Server Memory Price Increase – Q1 2026 Price Forecasts

- 4. DDR4 RAM Price Increase – Server Memory Outlook for 2026

- 5. DDR5 RAM Price Increase – Server Memory Outlook for 2026

- 6. DDR4 vs DDR5: Strategic Comparison for Buyers

- 7. Full-Year 2026 Price Projections

- 8. What This Means for Data Centers and Operators

- 9. Practical Takeaways for 2026 Procurement Planning

- DRAM Price Increase: Frequently Asked Questions (FAQ)

- Conclusion

- CoreWave DRAM & SSD Market Intelligence

Key Takeaways

- Server DRAM prices are undergoing a structural reset, not a short-term spike, driven by AI demand, cloud stockpiling, and capacity reallocation.

- DDR5 server memory faces the highest volatility, as AI and hyperscale platforms absorb a growing share of high-density RDIMM and LRDIMM supply.

- DDR4 remains widely deployed, but reduced production capacity is pushing prices higher despite ongoing DDR5 adoption.

- High-density modules (64GB and 128GB RDIMMs) are experiencing the strongest price pressure across both DDR4 and DDR5.

- Price stabilization is more likely than decline in 2026, with meaningful relief unlikely before 2027.

- Procurement timing now matters—delayed purchasing increases both cost and availability risk for data centers and operators.

Introduction: Why DRAM Prices Matter in 2026

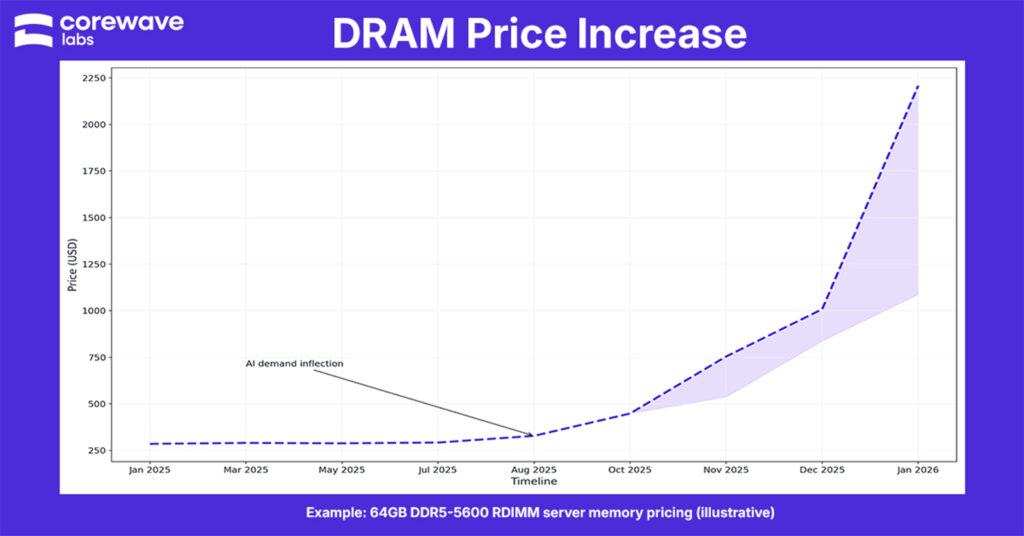

In the last few months, DRAM prices have gone parabolic. What began as AI-driven demand has escalated into reports of AI memory effectively being sold out, triggering an unprecedented surge across the memory market. Forecasts now point to DRAM prices nearly doubling by March 2026, while insider confidence has moved in the same direction, highlighted by Micron Technology director Teyin Liu purchasing $7.8 million in Micron shares. Even legacy segments are no longer insulated, underscoring how broad and structural the shift has become.

What we see on the ground reinforces this picture. There is a massive surge in RDIMM and SSD inquiries, limited immediately available supply, and a clear willingness from end customers to secure inventory early, often prioritizing availability over price. Procurement behavior has shifted from optimization to risk mitigation, a pattern typically seen only when markets move into structural imbalance.

- Server DRAM prices for DDR4 and DDR5 rose 45–50% in Q4 2025

- Q1 2026 Taiwan-based market watcher TrendForce projected to see 55-60% quarter-on-quarter increases for server DRAM

- DDR5 server RDIMMs are expected to double year-over-year by late 2026

- DDR4 prices jumped ~10% in a single week, signaling tightening supply even in legacy memory

- AI demand is absorbing capacity, with manufacturers prioritizing server DRAM and HBM

- Hyperscalers pulled forward large DRAM orders in late 2025, tightening availability for 2026

- Price increases are driven by structural demand and supply reallocation, not short-term shortages

- This shift is echoed in markets, with Micron stock up ~239% in 2025.

Server memory pricing is therefore undergoing a structural reset, not a temporary spike. For data centers, cloud providers, and telecom operators, DRAM is no longer a predictable component cost but a strategic variable that directly affects deployment timing, refresh cycles, and total system cost. This outlook focuses specifically on server-grade DDR4 and DDR5 RDIMM and LRDIMM modules, where pricing pressure and availability risk are most pronounced.

1. 2026 DRAM Market Snapshot

- Server DRAM is the fastest-rising segment within the global DRAM market

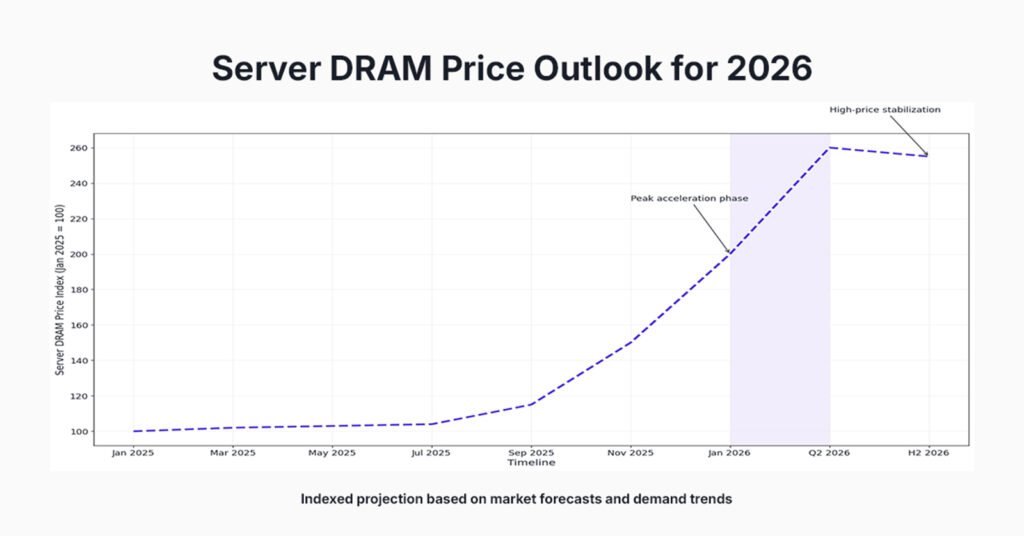

- Q1 2026 is expected to mark the peak acceleration phase, followed by stabilization at high levels

- Additional 50-60%+ gains are possible in Q2 2026, supported by server market growth of ~12.8%

- No meaningful price relief is expected before 2027, as demand continues to exceed supply expansion

- Conventional and consumer DRAM prices are rising, but less persistently than server DRAM

The 2026 DRAM market is defined by a sharp upward repricing followed by a prolonged high-price plateau. Server DRAM sits at the center of this shift, absorbing disproportionate demand from AI infrastructure and hyperscale deployments. While consumer DDR5 price spikes highlight broader supply stress, enterprise buyers face longer-lasting exposure due to non-elastic demand and limited substitution options.

2. Key Drivers Behind the DRAM Price Increase

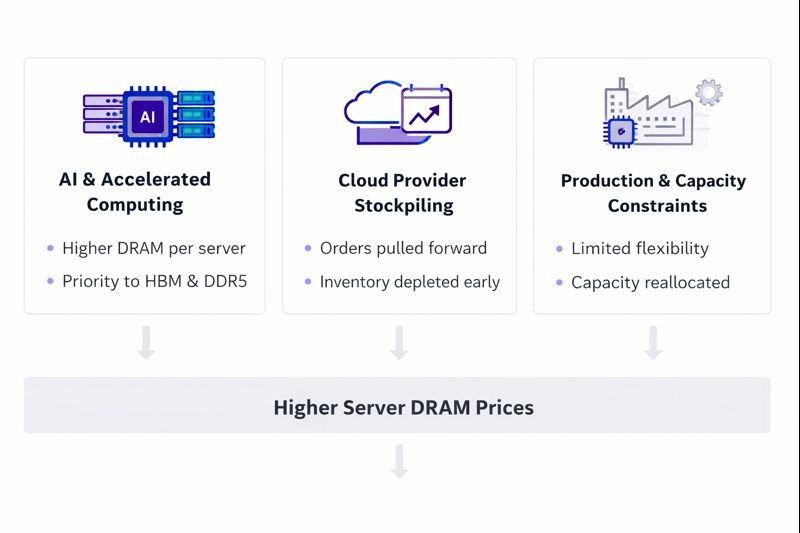

2.1 AI and Accelerated Computing Demand

- AI servers are consuming a disproportionate share of server-grade DRAM capacity

- Memory makers are prioritizing high-density RDIMM/LRDIMM and HBM over mainstream products

- AI platforms require larger memory footprints per server, amplifying unit demand

- Capacity shifts toward AI workloads reduce supply elasticity for general-purpose servers

AI infrastructure has fundamentally changed how DRAM capacity is allocated. Instead of optimizing for volume-driven segments, manufacturers are prioritizing high-margin, high-density memory for AI and accelerated computing. This has tightened availability across standard server configurations, even where absolute demand growth appears moderate.

2.2 Cloud Provider Stockpiling

- Major cloud providers pulled forward DRAM orders in late 2025

- Forward buying depleted channel and manufacturer inventories ahead of 2026

- Stockpiling was driven by expectations of supply tightness and rising prices

- Reduced buffer inventory leaves the market more sensitive to demand spikes

Hyperscaler procurement behavior has accelerated the price cycle. By front-loading large volumes of server DRAM, cloud providers effectively shifted demand from 2026 into 2025, leaving less inventory available for enterprise, telecom, and regional data center buyers as the new year begins.

2.3 Production and Capacity Constraints

- Wafer output growth remains incremental rather than step-change

- DRAM production is being reallocated away from legacy DDR4

- DDR5 shares manufacturing resources with graphics and mobile memory

- Capacity expansion lags demand growth across multiple high-priority segments

On the supply side, the constraint is not absolute scarcity but inflexibility. DRAM manufacturing lines cannot be rapidly rebalanced without cost and yield penalties. Recent moves such as Micron Technology’s $1.8B fab acquisition signal that new capacity is capital-intensive and slow to materialize, while emerging policy discussions around potential DRAM tariffs further raise the effective cost floor for production. As capacity is redirected toward DDR5, graphics, and mobile applications, legacy DDR4 and mid-tier server products face structural supply tightening.

3. Server Memory Price Increase – Q1 2026 Price Forecasts

- Server DRAM contract prices are forecast to rise over 60% quarter-on-quarter in Q1 2026

- Conventional DRAM is expected to rise 55–60% QoQ, trailing server DRAM

- Q4 2025 already delivered 45–50% price increases, setting a high baseline

- DDR5 server memory shows the strongest upward momentum within contracts

Q1 2026 represents the point where multiple pressures converge. Inventory depletion from late-2025 stockpiling meets accelerating AI demand and constrained production flexibility. The result is a sharp step-up in contract pricing, particularly for server DRAM, which establishes the elevated price environment expected to persist through the rest of 2026.

4. DDR4 RAM Price Increase – Server Memory Outlook for 2026

- DDR4 remains widely deployed in legacy and cost-sensitive server platforms

- Mainstream DDR4 spot prices have increased by around 10% recently, following broader DRAM market momentum

- Suppliers are actively deprioritizing DDR4 in favor of DDR5 and HBM production

- Capacity reallocation increases the risk of selective shortages, even where demand is stable

- Price increases are expected to be more moderate than DDR5, but availability may be uneven

Why DDR4 RAM Price increase? DDR4 continues to play a critical role in extending the life of existing server infrastructure, particularly in telecom, edge, and secondary data center deployments. However, as manufacturers shift capacity away from DDR4, the primary risk in 2026 is less about extreme price spikes and more about constrained availability and longer lead times for certain densities and configurations.

5. DDR5 RAM Price Increase – Server Memory Outlook for 2026

- DDR5 adoption is accelerating across new server platforms and refresh cycles

- Server-grade DDR5 RDIMMs, including 64GB modules, are projected to double in cost by late 2026

- Consumer DDR5 pricing has already tripled in some configurations since late 2025

- DDR5 production shares resources with graphics and mobile memory, amplifying competition for capacity

- AI and data center demand makes DDR5 the highest-priority and highest-volatility DRAM segment

DDR5 price increase as it sits at the intersection of multiple demand surges, making it the most exposed segment of the DRAM market. While consumer price movements illustrate the severity of supply pressure, server-grade DDR5 faces additional strain from AI workloads and hyperscale deployments. As a result, DDR5 pricing is not only higher than DDR4 but also subject to greater volatility throughout 2026.

6. DDR4 vs DDR5: Strategic Comparison for Buyers

- DDR4 prices are rising more moderately, while DDR5 prices show steep and accelerating increases

- DDR4 faces availability risk due to supplier deprioritization rather than extreme pricing

- DDR5 faces both price volatility and tighter supply, driven by AI and cloud demand

- DDR4 aligns with installed-base and legacy platforms nearing the end of their lifecycle

- DDR5 is tied to new server platforms with longer operational horizons

The choice between DDR4 and DDR5 in 2026 is less about raw performance and more about risk management. DDR4 offers relative price stability but increasing uncertainty around long-term availability. DDR5 supports future-facing platforms but exposes buyers to higher volatility and budget risk. Short-term procurement favors DDR4 where platform constraints allow, while long-term infrastructure planning increasingly forces a move toward DDR5 despite higher cost exposure.

7. Full-Year 2026 Price Projections

- DRAM prices are expected to peak sharply in Q1 2026 and then stabilize at elevated levels

- Further 20%+ increases remain possible in Q2, supported by continued demand growth

- No meaningful price correction is expected before 2027

- Server DRAM demand is reinforced by ~12.8% server market growth

- AI infrastructure and accelerated computing sustain structural demand pressure

The 2026 pricing environment is defined by persistence rather than volatility reversal. After the Q1 inflection point, prices are likely to plateau at high levels instead of retracing, as demand consistently outpaces incremental supply expansion. Server market growth and AI-driven deployments act as compounding forces, making any near-term relief structurally unlikely.

8. What This Means for Data Centers and Operators

- Memory costs are becoming a material budget variable, not a rounding error

- Server BOM assumptions made in 2024–2025 may no longer hold in 2026

- Delayed procurement increases exposure to both price escalation and lead-time risk

- Expansion projects face higher capital intensity per rack

- Refresh cycles risk being compressed or deferred due to memory cost pressure

For operators, DRAM pricing shifts directly affect capacity planning and financial predictability. Projects that depend on spot purchasing or late-stage procurement approvals are most exposed. As prices reset upward and availability tightens, waiting to buy increasingly becomes a cost risk rather than a savings strategy.

9. Practical Takeaways for 2026 Procurement Planning

- Price locking can reduce exposure when delivery timelines are known and budgets are fixed

- DDR4 procurement favors near-term needs tied to existing platforms

- DDR5 decisions should align with longer platform lifecycles, not short-term price expectations

- Staggered purchasing reduces timing risk but may increase average cost

- Supplier diversification becomes more important as allocation tightens

In a constrained DRAM market, procurement strategy matters as much as product selection. Buyers that align memory decisions with platform lifecycle and lock pricing where possible can reduce volatility exposure. The key trade-off in 2026 is not cheapest price, but controlled risk across timing, availability, and total system cost.

DRAM Price Increase: Frequently Asked Questions (FAQ)

1. Why is the DRAM price going up?

DRAM prices are rising because demand from AI, cloud, and data centers is growing faster than supply, while manufacturers are reallocating capacity toward higher-margin products.

2. Is AI causing RAM prices to go up?

Yes. AI servers require much more memory per system and consume a disproportionate share of DRAM and HBM capacity, tightening supply for other buyers.

3. Why have DDR4 and DDR5 server memory prices gone up?

DDR5 demand is accelerating for new platforms, while DDR4 supply is being reduced, creating price pressure across both generations.

4. Why are DDR5 RDIMM prices rising faster than DDR4?

DDR5 RDIMMs are used heavily in AI and hyperscale servers and compete for capacity with graphics and mobile memory, driving faster price increases.

5. Why is DDR4 still increasing in price despite DDR5 adoption?

DDR4 production is being deprioritized, so reduced supply is pushing prices up even as newer platforms move to DDR5.

6. How long will the DDR5 shortage last?

The DDR5 shortage is expected to last through most of 2026, with meaningful relief unlikely before 2027.

7. Will DDR4 and DDR5 RAM prices go down in 2026?

A broad price decline is unlikely in 2026. Prices may stabilize after early-year peaks, but continued demand and limited supply keep downward pressure minimal.

8. How long are server RAM prices expected to stay high?

Server RAM prices are expected to remain elevated throughout 2026, with meaningful relief more likely in 2027 as supply and demand rebalance.

9. How should enterprises buy server RAM during a price increase?

Enterprises should focus on securing supply and locking prices for planned projects rather than waiting for short-term price corrections.

10. Which server memory capacities are most affected by price increases?

High-density modules such as 64GB and 128GB RDIMMs are seeing the strongest price pressure due to heavy use in AI and cloud deployments.

11. What factors would cause server RAM prices to stabilize again?

Prices would stabilize if new capacity comes online or demand growth slows, neither of which is expected before 2027.

Conclusion

Server memory pricing in 2026 is no longer behaving like a typical component cycle. What began as AI-driven demand has evolved into a structural reset, where capacity allocation, hyperscaler behavior, and manufacturing constraints collectively define pricing and availability. For DDR4 and DDR5 server memory, cost predictability has been replaced by strategic timing and supply risk management.

- DDR5 RDIMM and LRDIMM pricing is most exposed to volatility due to AI and cloud demand.

- DDR4 remains relevant, but declining production capacity is keeping prices elevated.

- High-density modules (64GB, 128GB) face the strongest pressure across both generations.

- Price stabilization is more likely than reversal in 2026, with relief pushed toward 2027.

For data centers, cloud providers, and telecom operators, DRAM is no longer a passive bill-of-materials item. Memory procurement decisions now directly affect deployment timelines, refresh cycles, and total infrastructure cost. Organizations that treat server memory as a strategic input—rather than a commodity—will be better positioned to navigate the current upcycle.

CoreWave DRAM & SSD Market Intelligence

Weekly pricing levels, stock quantities & EU/global availability on DDR4/DDR5 and Enterprise SSDs.

About the Author

Edgars Zukovskis

Board Member | CoreWave Labs

14+ years of expertise helping telecom operators, datacenters, and system integrators build efficient, cost-effective networks using compatible hardware solutions.

Recommended Reads

Discover insights to power your infrastructure.